Entrepreneurs will face legal issues when running a business. It’s unavoidable. But there are things that you can do to prevent these legal issues from upending your business. Here are five business legal tips that will help you with legal issues entrepreneurs commonly face.

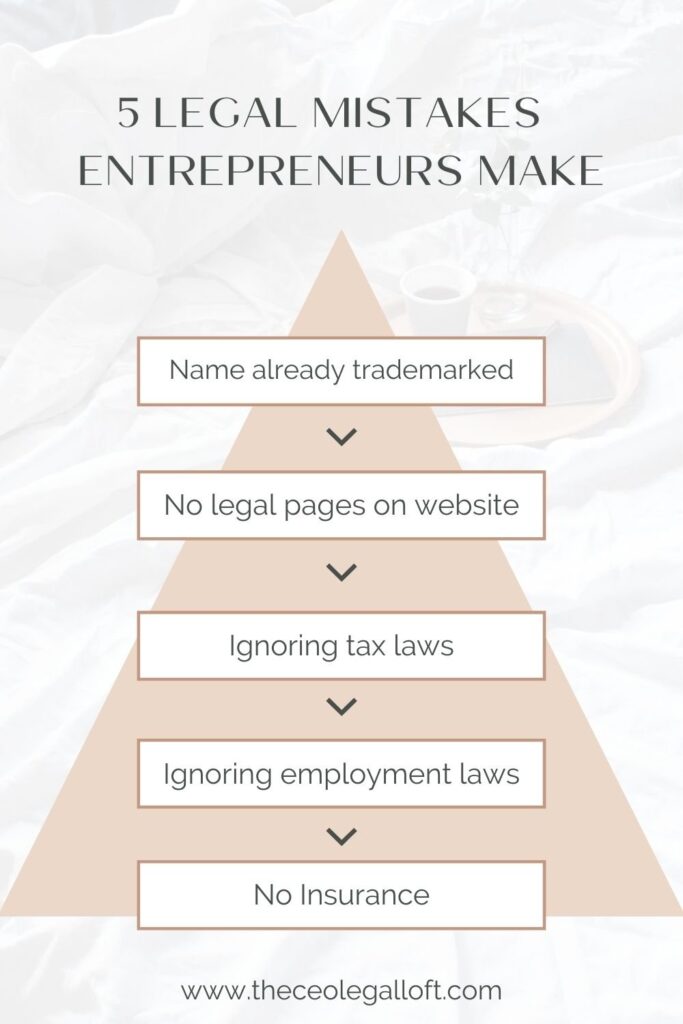

1. Name you’ve chosen for the business, course, or coaching program is already trademarked

How long does it take you to come up with a catchy name for your business or course? If you’re anything like me, it can take months or even weeks. When you finally think of something that sticks, you want to start letting your audience know. But sometimes, we’ve come up with a name that’s really similar to a name that has already been trademarked.

What’s a trademark?

According to the United States Patent and Trademark Office, a trademark is a word, phrase, symbol, design, or a combination of these things that identifies your goods or services. It’s how customers recognize you in the marketplace and distinguish you from your competitors.

When you are using a trademark that is similar to someone else’s, you are infringing on their trademark rights. And with infringement comes consequences. If you’re infringing on a trademark you can receive criminal or civil penalties, including:

- A court order to stop using the trademark

- Court order to destroy the infringing materials

- Paying the plaintiff profits from what you made from using the trademark, actual or statutory damages, and the costs of the action

- Attorney’s fees

Trademark infringement cases can cost hundreds of thousands of dollars. A business legal tip to avoid infringing on another company or individual’s trademark is to search on tess2.uspto.gov, Google, and social media platforms before you start promoting your new venture.

2. You don’t have the right legal pages on your website

This business legal tip could be a whole blog post of its own. When you have a website, you’ll need terms and conditions for your small business, privacy policy, and legal disclaimers and disclosures to protect you from visitors as well as be legally compliant. Here is what each legal page does for your website.

- Terms and Conditions are a contract that includes rules on how to behave on your website, as well as expectations. A user must agree to your terms and conditions in order to use or access your website.

- Privacy policies are required by law if you are collecting personal identifiable information, like emails or credit cards. Additionally, if you have California visitors or EU, you’ll need a privacy policy that follows CCPA (California Consumer Privacy Act) and GDPR (General Data Protection Regulation), respectively. A privacy policy is a document that’s on your website explaining how you will collect, store, protect, and utilize personal information that your users give you.

- Website disclaimers are a notice placed on your website to limit your liability for the outcome of the use of your site. Your readers understand that by using the information on your website, that they are taking a risk. Website disclaimers also protect you from 3rd parties who may make comments or advertise on your website. A disclaimer from 3rd parties will state that any opinions that are made by 3rd parties are not yours (or your organization) and will shield you from any harmful content that they put on your site. Some common disclaimers are errors and omissions, professional- client relationship, testimonial disclaimers, and comment disclaimers.

Although all of these pages are not required by law, it will help prevent lawsuits in the future. If you need all three of these legal pages you can get the website terms of use and privacy policy template bundle on The CEO Legal Loft shop for your small business.

3. You’re not taking advantage of tax laws

Remember that episode of Schitt’s Creek where David Rose bought a bunch of stuff and said he would just write it off. I mean he kind of had the right idea, but the money will be coming out of your pocket. “Write-offs” are expenses that you may be able to deduct on your federal income tax return.

- When you purchase a planner for your business, that’s a write off.

- When you go to the store to pick up something for your business, that’s a write off of your mileage.

- If you pay yourself a salary, that’s a write off.

Many times, business owners aren’t tracking their expenses and missing out on these deductions. Additionally, if you’re making enough to pay yourself a salary, you should think about electing for s-corporation status. But make sure you talk with your accountant before doing this because there are certain rules that you have to follow.

4. You’re treating independent contractors as employees

After going into business, and trying to do it all on your own, you’re eventually going to have to hire help. This can be an employee or an independent contractor.

What’s the difference between an employee or an independent contractor?

According to the IRS, the general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work. So if your worker has to work in a certain place, you dictate their hours, and have some sort of financial control over them, then they are more likely classified as an employee. According to the IRS, If you classify an employee as an independent contractor and you have no reasonable basis for doing so, you may be held liable for employment taxes for that worker.

5. You don’t have liability insurance

Just like you have car insurance to protect you from accidents, the same goes for business insurance. This is a legal issue entrepreneurs face that is often overlooked.

There are two common types of insurance that business owners have, general liability and professional liability.

What is the difference between general liability and professional liability insurance?

- General liability insurance covers common business risks like customer injury, customer property damage, defamation, libel, or slander, court and legal fees, and advertising injury. When you have general liability insurance, you can protect your bank account from the high cost of lawsuits, as well as qualify for leases and contracts.

- Professional liability insurance, also known as malpractice insurance, protects professionals such as accountants, lawyers, and physicians against negligence and other claims that clients bring against you.

Most major insurance providers offer liability insurance. You can also reach out to an insurance broker who will help you find the best price and coverage. The legal issues discussed in this post are just the tip of what you need to think about when running your own business. But these are the more common issues that I see from clients. If you’d like to learn more about legally setting up your business for success, grab The CEO Legal Kit.

This is a foundational guide where you’ll learn more about what you need to protect your business. This kit also comes with disclaimers and disclosures for your website and the refund policy templates you need so your customers or clients know what to expect if they want their money back.

+ show Comments

- Hide Comments

add a comment