As an online business owner, you’ve likely experienced the dreaded chargeback at least once in your operational journey. It’s one of those things that can disrupt your cash flow, damage your reputation, and even threaten the sustainability of your business if not properly managed. But fear not! I’m here to guide you on how to navigate how to fight chargebacks.

Chargebacks are more than just an inconvenience—they’re a multifaceted challenge that can have a ripple effect across your entire business. They can stem from various reasons, ranging from a legitimate chargeback dispute to fraudulent activities.

Understanding the root causes and implementing robust strategies to prevent them is crucial for maintaining a healthy business environment.

In this comprehensive guide, we’ll delve into the anatomy of the chargeback process, exploring the common reasons behind them and the impact they can have on your business. We’ll then arm you with practical tips and proven strategies to reduce your chargeback ratio, ensuring you keep more of your hard-earned revenue where it belongs—in your pocket.

What is a Chargeback?

Before diving into strategies, let’s first define what a chargeback is. In simple terms, it’s when a customer disputes a charge from your business with their credit card company or bank. If the credit card dispute is successful, the funds are returned to the customer, leaving you with less revenue and potentially hefty fees.

Chargebacks were created to protect customers from fraud or unauthorized transactions. But today, they can be used for many reasons, not all of them fair. When a chargeback happens, the bank or credit card company takes the disputed amount from your account and holds it while they investigate.

If they decide the customer wins the chargeback dispute, they keep the money and give it back to the customer. This means you lose that money and might have to pay a chargeback fee.

Too many of these can also hurt your relationship with payment processors, making it more expensive or even impossible to process future payments. Knowing what chargebacks are and how they work is key to preventing them and protecting your business.

Why Do Chargebacks Occur?

Chargebacks can happen for a variety of reasons, each of which can impact your business differently. Understanding these reasons can help you develop strategies to prevent them and protect your revenue.

One common cause of disputes is fraudulent transactions. This occurs when someone uses stolen credit card information to make a purchase. The actual cardholder, will notice the unauthorized charge, dispute it with their bank, leading to a chargeback.

Another reason is customer dissatisfaction. If a customer is unhappy with your product or service, they might feel that their only option is to request a chargeback. This could be due to the product not meeting their expectations, poor quality, or issues with shipping and delivery.

Simple misunderstandings can also lead to chargebacks. For example, a customer might not recognize a charge on their statement because of how it appears, or they might forget about a subscription they signed up for. Incorrect billing, such as charging the wrong amount or billing the customer multiple times, can also trigger chargebacks.

Sometimes, customers might use chargebacks as a convenient way to get their money back, even when they don’t have a valid reason. This is known as “friendly fraud” and can be particularly challenging to manage.

Understanding why chargebacks occur is the first step in creating effective strategies to prevent them. By addressing the root causes—whether through improving customer service, ensuring clear billing practices, or enhancing fraud prevention measures—you can reduce the frequency of chargebacks and maintain a healthier bottom line for your business.

How To Win The Chargeback Battle

Now that we’ve set the stage, let’s delve into some practical steps you can take to prevent chargebacks and win the battle when you receive one:

Clear and Detailed Product Descriptions

Ensure your product descriptions are clear, detailed, and accurate. This way, customers know exactly what they’re getting before they make a purchase. Ambiguity breeds dissatisfaction and dissatisfaction breeds chargebacks.

Having clear and detailed product descriptions helps set the right expectations for your customers. When people shop online, they rely heavily on the information you provide to make informed decisions. If your descriptions are vague or misleading, customers might feel disappointed or misled when they receive the product, leading to a higher likelihood of chargebacks.

Here are some tips to make sure your product descriptions help prevent chargebacks:

- Include Key Features and Specifications: Make sure to list all the important features and specifications of your product. This could include size, color, material, dimensions, and any special features. The more detailed you are, the less room there is for misunderstandings.

- Use High-Quality Images and Videos: Visuals are crucial in online shopping. Provide multiple high-quality images from different angles, and if possible, include a video showcasing the product. This helps customers get a better sense of what they are buying.

- Be Honest and Transparent: If there are any limitations or potential downsides to your product, be upfront about them. Customers appreciate honesty, and it’s better to set realistic expectations than to deal with disappointed buyers.

- Provide Usage Instructions: If your product requires assembly or has specific usage instructions, include these in your description. This not only helps customers use the product correctly but also reduces the chances of dissatisfaction.

- Highlight Benefits: While it’s important to be detailed about the features, also focus on the benefits. Explain how the product can solve a problem or improve the customer’s life. This helps create a connection and can reduce the likelihood of chargebacks due to unmet expectations.

By taking the time to craft clear and detailed product descriptions, you can significantly reduce the chances of misunderstandings and dissatisfaction. This, in turn, helps lower the risk of chargebacks and ensures a smoother, more positive experience for your customers.

Excellent Customer Service

In many cases, customers resort to chargebacks because they feel ignored or undervalued by the merchant’s customer service team. Prioritize responsive and effective customer service as part of your strategy to reduce chargebacks.

Providing excellent customer service can make a significant difference in how customers perceive your business and their willingness to resolve issues directly with you rather than through their bank. Here are some key strategies to ensure your customer service is top-notch:

- Be Responsive: Respond to customer inquiries and complaints promptly. A quick acknowledgment can go a long way in making customers feel valued. Aim to answer emails within 24 hours and provide immediate responses through live chat or phone support.

- Train Your Team: Ensure your customer service team is well-trained and equipped to handle various issues. They should be knowledgeable about your products, policies, and procedures and able to resolve problems efficiently and empathetically.

- Offer Multiple Contact Channels: Make it easy for customers to reach you by offering various contact methods, such as email, phone, live chat, and social media. Some customers prefer one method over another, so providing options can enhance their experience.

- Resolve Issues Quickly and Fairly: When a customer contacts you with a problem, strive to resolve it as quickly and fairly as possible. Offer solutions such as refunds, exchanges, or discounts when appropriate. Showing a willingness to fix problems can prevent customers from feeling the need to file a chargeback.

- Follow Up: After resolving an issue, follow up with the customer to ensure they are satisfied with the outcome. This demonstrates that you care about their experience and are committed to their satisfaction.

Transparent Return and Refund Policy

Having a clearly stated return and refund policy can dissuade customers from initiating the dispute process. Make sure it’s easily accessible on your website and straightforward to understand.

A transparent return and refund policy can significantly reduce the likelihood of chargebacks by setting clear expectations and providing customers with a straightforward way to resolve their issues. Here’s how to ensure your return and refund policy helps prevent chargebacks:

- Be Clear and Concise: Write your return and refund policy in simple, easy-to-understand language. Avoid legal jargon or complex terms that might confuse customers. The clearer the policy, the less room there is for misunderstandings.

- Outline the Process: Clearly explain the steps customers need to take to return an item and request a refund. Include details on how to initiate a return, what information they need to provide, and where to send the item. Providing a step-by-step guide can make the process less intimidating.

- Specify Time Frames: State the time frames within which returns are accepted and refunds are processed. Whether it’s 30 days, 60 days, or another period, make sure customers know how long they have to return a product and when they can expect to receive their refund. This helps manage their expectations and reduces the chance of disputes.

- Detail Accepted Conditions: Describe the condition in which items need to be returned. For example, specify if items must be unused, in their original packaging, or if certain items (like final sale or personalized products) are non-returnable. Clear guidelines can prevent misunderstandings and unwarranted chargebacks.

- Explain Refund Methods: Let customers know how they will be refunded. Whether it’s a full refund, store credit, or an exchange, be upfront about what they can expect. If there are restocking fees or other deductions, these should be clearly stated.

- Highlight Contact Information: Make it easy for customers to contact you if they have questions about the return and refund policy or need assistance with a return. Providing a dedicated customer service email or phone number can help resolve issues before they escalate to chargebacks.

- Make It Accessible: Ensure your return and refund policy is prominently displayed on your website. Place links in easy-to-find locations such as the footer, checkout page, and product pages. A hidden or hard-to-find return policy can frustrate customers and increase the likelihood of chargebacks.

- Use Positive Language: Frame your return and refund policy in a positive, customer-friendly tone. Instead of focusing on restrictions, emphasize your commitment to customer satisfaction. For example, “We want you to be happy with your purchase. If you’re not completely satisfied, our easy return and refund process is here to help.”

By having a transparent and easily accessible return and refund policy, you can provide customers with a clear, fair process for returning items and receiving refunds. This reduces frustration and builds trust, making it less likely that customers will resort to chargebacks to resolve their issues.

When customers feel confident in your return and refund policy, they are more likely to work with you directly to find a solution, ultimately protecting your revenue and maintaining positive customer relationships.

Implement Fraud Detection Measures

To combat fraudulent chargebacks, implement robust security measures like address verification and CVV checks. You might also consider using fraud detection software that can flag suspicious transactions.

Fraudulent chargebacks occur when someone uses stolen credit card information to make a purchase. These chargebacks not only lead to financial losses but can also damage your business’s reputation. Implementing strong fraud detection measures can help you identify and prevent these fraudulent transactions before they impact your bottom line.

Here are some effective fraud detection measures to consider:

- Address Verification Service (AVS): AVS compares the billing address provided by the customer with the address on file with the credit card issuer. If the addresses don’t match, the transaction can be flagged for further review. This helps ensure that the person making the purchase is the legitimate cardholder.

- Card Verification Value (CVV) Checks: Require customers to enter the CVV number from their credit card. This three- or four-digit code is found on the card and helps verify that the customer has the physical card in their possession, adding an extra layer of security to the transaction.

- Monitor Transactions in Real-Time: Set up real-time monitoring for transactions to quickly identify and respond to suspicious activity. Look for red flags such as multiple orders from the same IP address using different credit cards or unusually large orders.

- Implement Two-Factor Authentication (2FA): For higher-risk transactions, consider implementing 2FA, which requires customers to verify their identity through an additional method, such as a text message or email code. This can significantly reduce the risk of fraudulent transactions.

- Set Transaction Limits: Establish limits for transaction amounts and the number of transactions allowed within a specific period. This can help prevent fraudsters from making large or multiple purchases in a short time frame.

By implementing these fraud detection measures, you can significantly reduce the risk of fraudulent chargebacks. Protecting your business from fraud not only safeguards your revenue but also enhances customer trust, as they feel more secure knowing you take their security seriously.

Effective fraud prevention is a critical component of a comprehensive strategy to win the chargeback battle and maintain a healthy, thriving business.

Promptly Respond to Chargeback Notifications

Once you receive a notification and decide to fight a chargeback, time is of the essence. Quickly gather all necessary documentation such as invoices, delivery confirmations, and customer correspondence to dispute the chargeback.

Promptly responding to chargeback notifications is crucial in protecting your revenue and maintaining a good relationship with payment processors. When you receive a chargeback notification, it means a customer has disputed a transaction, and you have a limited amount of time to respond. Here’s how to effectively manage and dispute chargebacks:

- Understand the Notification: Carefully read the chargeback notification to understand the chargeback reason code for the dispute. Knowing the specific reason can help you gather the right evidence and tailor your response accordingly.

- Organize Your Documentation: Collect all relevant documentation that supports the legitimacy of the transaction. This might include:

- Invoices and Receipts: Proof of the transaction details, including the date, amount, and items purchased.

- Delivery Confirmations: Tracking information or delivery receipts that show the product was delivered to the correct address.

- Customer Correspondence: Emails, chat logs, or phone records that demonstrate communication with the customer, particularly if they acknowledged the purchase or expressed satisfaction.

- Terms and Conditions: A copy of your return policy or terms and conditions that the customer agreed to during the purchase process.

- Proof of Authorization: Any additional proof that the cardholder authorized the transaction, such as signed agreements or order forms.

- Submit Your Response Promptly: Time is critical when disputing chargebacks. Submit your response and supporting documents as quickly as possible to ensure they are reviewed before the deadline. Delayed responses can result in automatic loss of the dispute.

- Follow the Processor’s Guidelines: Each payment processor has specific guidelines and procedures for disputing chargebacks. Make sure to follow these guidelines carefully to avoid any procedural errors that could weaken your case.

- Be Clear and Concise: When submitting your response, present your evidence in a clear, organized, and concise manner. Highlight the key points that support your case and address the reason for the chargeback directly. Avoid including unnecessary information that could confuse the reviewer.

By promptly responding to chargeback notifications with well-organized and compelling evidence, you increase your chances of successfully disputing the chargeback and retaining your revenue. This proactive approach not only helps reduce your financial losses but also demonstrates your commitment to maintaining a transparent and trustworthy business.

Effective chargeback management is an essential part of your overall strategy to win the chargeback battle and ensure the long-term success of your online business.

Your legal strategy to win a chargeback

Terms and Conditions Agreement

This document outlines the rules that customers must agree to follow in order to use your service or product. It should include clauses about payment terms, refunds, disputes, and other relevant matters.

Having a good Terms and Conditions Agreement can help protect your business from chargebacks. By clearly explaining the rules and expectations for both your business and your customers, you can prevent misunderstandings and solve problems more easily. Here’s how to create a clear and helpful Terms and Conditions Agreement:

- Payment Terms: Clearly explain how customers should pay you, including the payment methods you accept, when payments are due, and any late fees for missed payments. This helps avoid confusion about payments.

- Return and Refund Policy: Include detailed information about how customers can return products and get refunds. Explain when returns are allowed, how long customers have to return items, and how to request a refund. Clear rules make it easier for customers to understand their options and can prevent chargebacks.

- Chargeback Policy: Address chargebacks specifically. Ask customers to contact your customer service team to resolve any issues before they file a chargeback. Explain how you will investigate and solve disputes, and what happens if a chargeback is filed without trying to resolve it with you first.

- Dispute Resolution: Describe how disputes will be handled. This could include methods like mediation or arbitration. Providing a clear way to resolve disputes can reduce the chances of customers filing chargebacks.

- Product Descriptions and Warranties: Make sure your product descriptions are accurate and clearly state any warranties or guarantees. This helps set the right expectations for customers and can prevent dissatisfaction.

- Legal Jurisdiction: Specify which laws govern your agreement. This helps streamline the process if a dispute goes to court.

- Acceptance of Terms: Make it clear that by using your service or product, customers agree to your Terms and Conditions. You can do this with a checkbox during checkout or by requiring customers to sign or acknowledge the agreement.

- Updates and Changes: Reserve the right to update or change your Terms and Conditions. Notify customers of any important changes and provide a way for them to review and accept the new terms.

By including these elements in your Terms and Conditions Agreement, you create a clear document that protects your business and sets clear expectations for your customers. This can help prevent misunderstandings and disputes that lead to chargebacks, keeping your business healthy and secure.

Having a strong Terms and Conditions Agreement is not only necessary but also a smart way to build trust with your customers. It can help reduce the risk of chargebacks and support the long-term success of your business.

Privacy Policy

In today’s world, keeping customer information safe is very important. A privacy policy is a document that explains how your business collects, uses, and protects customer data. It should clearly state what personal information you collect, like names, addresses, email addresses, and payment details. Being open about what data you collect helps customers feel safe and know what’s happening with their information.

Your privacy policy should also explain how you use and share this data. For example, it should tell if you share data with other companies to process payments or send orders, and make sure those companies also follow data protection rules.

The policy should describe how you keep data safe, like using secure servers and encryption. It should also inform customers about their rights to see, change, or delete their data. A clear and honest privacy policy helps build trust and prevents misunderstandings, making customers feel more comfortable doing business with you.

Secure Payment Processing

Keeping payment information safe is crucial to avoid problems like fraud and chargebacks. Using a well-known payment processor that follows security standards (like PCI-DSS) helps protect card details during transactions. These standards are designed to keep payment information safe from hackers. Choosing a reliable processor with a good security record helps ensure that customer payments are secure.

Besides following security standards, it’s important to use advanced tools like encryption and tokenization. Encryption turns data into a secure code, and tokenization replaces sensitive information with a special code that can’t be misused if stolen.

Using fraud detection tools to monitor transactions for any unusual activity can also help prevent fraud. Regularly checking your security measures and having good customer support from your payment processor can keep your payment system safe and efficient, building trust with your customers.

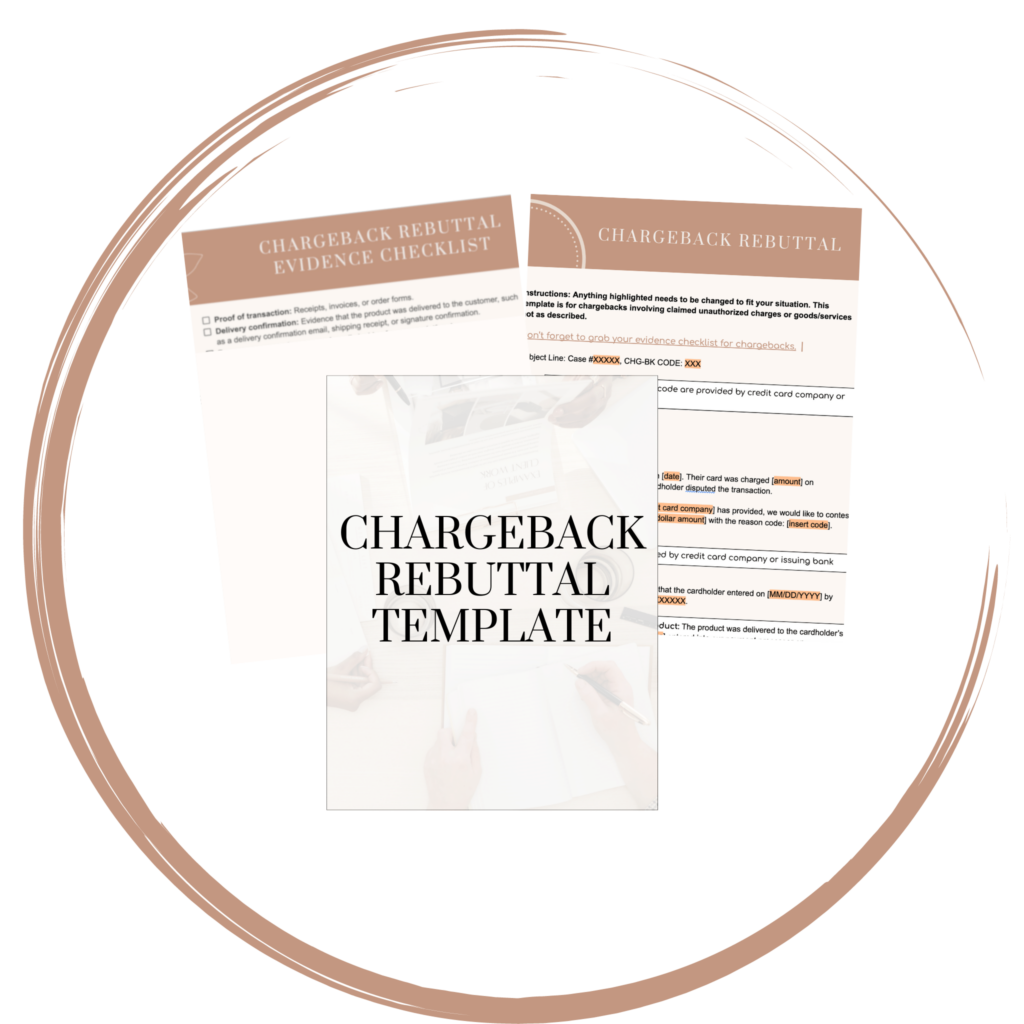

Win a chargeback dispute using a chargeback rebuttal template

Chargebacks can be a significant challenge for any online business, but with the right strategies, you can minimize their impact and protect your revenue. By implementing clear product descriptions, excellent customer service, a transparent return and refund policy, fraud detection measures, and secure payment processing, you can reduce the likelihood of chargebacks and maintain a healthy business.

However, even with these precautions, chargebacks can still occur. When they do, having a strong response ready is crucial. That’s where our Chargeback Rebuttal Letter Template comes in. This ultimate solution is designed to help you appeal a chargeback and recover your hard-earned revenue.

With our easy-to-use template, you can craft a powerful rebuttal letter that clearly demonstrates the validity of the disputed transaction. It includes a checklist to gather all necessary evidence and provides a compelling, professional letter to present your case in the best possible light. Our template saves you time and money by eliminating the need to hire expensive legal or financial experts, allowing you to create a customized and persuasive chargeback rebuttal tailored to your situation.

+ show Comments

- Hide Comments

add a comment