Is your management structure a single member LLC? Are you running it without an operating agreement, usually an internal document in your business? If so, you might want to read on…

How do I protect myself as a single-member LLC?

There are a few things you can do to protect yourself as a single-member LLC. First, create an operating agreement that outlines the rules and regulations for your business (we’ll discuss this more below). This will help to keep things organized and clear, and will also provide a level of protection if there are any disputes. You can also choose to have your LLC taxed as a corporation (s-corporation), which can provide some additional protections. Finally, you can purchase liability insurance, which will help to cover any damages or losses that may occur.

What is a single member LLC operating agreement?

A written operating agreement is an essential legal document for a single member LLC. It is the roadmap to your LLC with its own rules. An LLC’s operating agreement will help guide you in the creation of any additional companies within the same group. Why is this important?

Even if it’s a one-person operation, an LLC is still a separate legal entity from its owner.

This means that you as the sole owner of a limited liability company need to deal with certain legal matters that are different than those of sole proprietorships or partnerships.

A single-member llc operating agreement sets forth the rules of the LLC’s operations. It’s a document that spells out how the business will be managed, how you make a business decision, and who will be responsible for what. It also lays out the rules for how profits and losses are distributed among members.

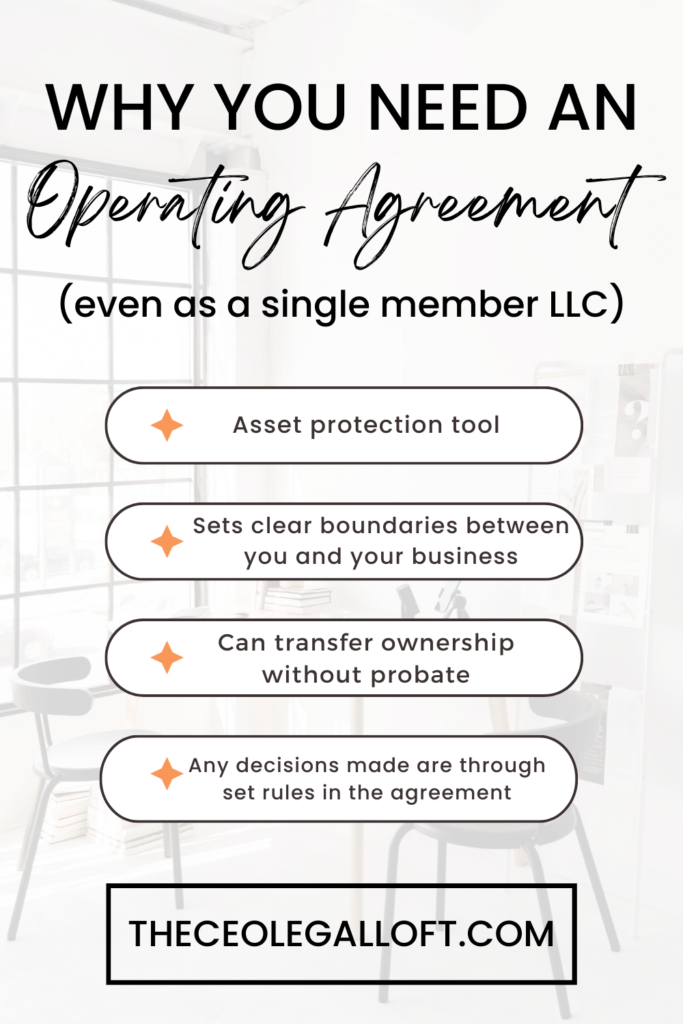

While it may seem unnecessary to have an operating agreement if you plan to operate a single-member limited liability company, there are several reasons why you should still get an operating agreement in place:

- It’s an asset protection tool for liability related to your business activities;

- It helps protect your personal assets by creating clear boundaries between your business and you personally;

- It allows you to transfer ownership of the business without having to go through probate court if you pass away; and

- It ensures that any decisions made by members are made according to the rules set forth in your operating agreement rather than based on their own discretion or personal preferences.

Without an operating agreement, state law may determine how your single-member LLC operates.

If you don’t have a well-crafted operating agreement and something happens to you, like getting sick or injured or if you pass away, the default rules of your state will apply to your LLC. That’s disadvantageous because it could mean that all of your assets go into probate and may be subject to claims by creditors.

Additionally, your LLC could be transferred to someone who you didn’t want it to and has no clue how you run the business.

Having a properly drafted operating agreement gives everyone involved with the business peace of mind knowing that they’re protected from liability, can make decisions without having to worry about being sued by other parties, and knows what their rights are if something happens to you.

An operating agreement helps prove that your business is not being run as a sole proprietorship.

Sole proprietorships are owned by one individual and their personal assets are liable for debts incurred by the business. An LLC protects members from personal liability for business debts and other obligations, which means you need evidence proving that it’s a separate entity from you personally.

An operating agreement serves as this proof by outlining how members handle profits and losses, how much each member owns of the company (even if it’s just you), and how decisions will be made.

It helps prove that you have liability protection and that your business has its own assets and income.

When you chose your LLC as a business entity, usually it’s to enjoy limited liability status. A single member LLC operating agreement helps with limited liability protection. If your LLC is sued, your personal assets are protected from creditors if they’re held in a separate entity — in this case, your LLC — unless there’s fraud or negligence involved in the company’s activities.

Additionally, if you ever file for bankruptcy protection or want to dissolve your company in court (called judicial dissolution), an operating agreement makes sure that your personal assets aren’t on the line when it comes to paying off creditors.

Some states require an operating agreement as part of your formation paperwork.

In most states, an operating agreement is not legal requirement for single-member LLCs. However, some states require that you have an operating agreement even if you have a single member operating agreement.

For example, a California LLC with a sole member must file articles of organization and a statement of information with the Secretary of State. Both forms require the name and address of the manager (president) and member (owner).

In addition, California requires that an LLC’s articles of organization be notarized and filed with the state. The notary makes sure that all information on the document is true and correct before stamping it with their official seal. They also verify that all signatures on the document are authentic and properly authorized by the individuals who signed them.

Here are the other states, besides California, that require an operating agreement, even if you are a single member operating LLC:

- New York

- Missouri

- Maine

- Delaware

Can I create my own operating agreement?

Yes, you can make your own operating agreement, but it is generally advisable to have an attorney help you with this process. An operating agreement is a contract between the owners of a business that outlines the rights and responsibilities of each owner, as well as how the business will be run. This document can be very complex, so it is important to make sure that it is thorough and covers all possible scenarios. Having an experienced attorney review your operating agreement can help ensure that it is legally binding and will protect your interests in the event of a dispute. On The CEO Legal Loft shop, you can find a single member LLC operating agreement template.

Takeaway: A single member LLC needs an operating agreement for their business.

An operating agreement for single-member LLCs is a must. While LLC’s are sometimes left to state law, some states require that an LLC include some sort of formal document to do business in its charter (the part of a company that specifies how it will be operated). Moreover, if the LLC does not have an operating agreement, then the entire LLC is governed by the state’s default rules. This can get very complicated and confusing very quickly, so it’s best to set the rules you want yourself.

+ show Comments

- Hide Comments

add a comment